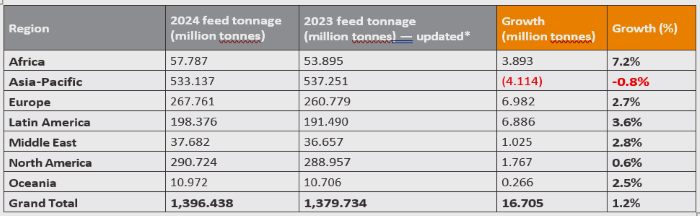

Global feed production grew by 1.2% in 2024, reaching 1.396 billion tonnes, according to Alltech’s 2025 Agri-Food Outlook. This rebound—an increase of 16.7 million tonnes marks a return to growth after a stagnant 2023, demonstrating the resilience of the global feed industry amid ongoing volatility.

Global feed production grew by 1.2% in 2024, reaching 1.396 billion tonnes, according to Alltech’s 2025 Agri-Food Outlook. This rebound—an increase of 16.7 million tonnes marks a return to growth after a stagnant 2023, demonstrating the resilience of the global feed industry amid ongoing volatility.

Producers navigated a challenging landscape shaped by disease outbreaks, climate disruptions, and economic uncertainty. Despite these pressures, most regions reported growth. Latin America led with a 3.6% increase, followed by Africa and the Middle East at 5.4%, and Europe at 2.7%. The exception was Asia-Pacific, the world’s largest feed-producing region, which saw a 0.8% decline, a drop of 4.1 million tonnes, driven largely by contractions in China (Table 1).

Despite the decline, Asia-Pacific still accounted for 533.1 million tonnes, or approximately 38% of global feed output. China’s 6.5 million-tonne reduction across pig, dairy, beef, and aquafeeds reflects disease pressures, market oversupply, and ongoing industry consolidation.

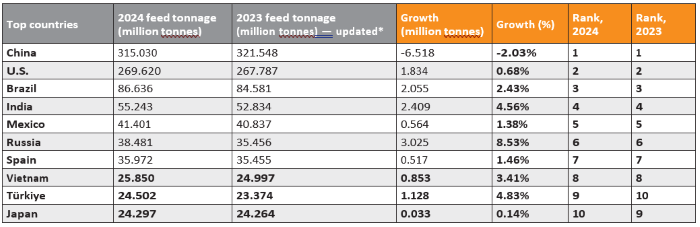

The top 10 feed-producing countries remained largely unchanged in 2024 (Table 2), collectively accounting for 65.6% of global feed output, slightly down from 66.0% in 2023. China, the U.S., Brazil, and India represented about 52% of global feed consumption, underscoring their central role in shaping agricultural demand and trends.

Growth in poultry and ruminant sectors, while pig and aquafeed decline

By species, poultry feed remained dominant, making up 42.7% of total feed volume. Pig feed, the second-largest segment at 26.4%, declined by 2.1 million tonnes, continuing its downward trend from 2023. In contrast, the ruminant segment (beef and dairy combined) recorded strong gains, adding 7.4 million tonnes.

Aquafeed, however, declined by 602,000 tonnes, falling from 53.57 million to 52.97 million tonnes, a 1.1% drop year-over-year (Table 3). This marks the second consecutive year of contraction in global aquafeed production.

Regional aquafeed trends:

A mixed outlook

While the global aquafeed market declined overall, regional trends varied significantly (Table 4). Asia-Pacific, still the largest aquafeed-producing region, recorded a 1.7% decrease, driven by environmental disruptions, disease outbreaks, and persistently low fish prices. The shift toward more economical alternatives such as fermented feeds and byproducts, along with challenges in broodstock supply, further contributed to the decline.

Contraction in Latin and North America

Latin America saw a 2.3% contraction, primarily due to new import tax regulations and decreased shrimp feed demand in Ecuador. However, Chile and Peru performed better, aided by favourable environmental conditions such as cooler waters. Government support measures in Brazil and Chile—including feed subsidies and export incentives—may support future recovery.

In North America, aquafeed production declined by 3.7%. Key challenges included sea lice and winter ulcers in salmon farms, coupled with weak shrimp feed demand amid overproduction. Economic difficulties along the U.S. Gulf Coast led to cutbacks, culminating in the early 2025 bankruptcy of the country’s largest shrimp producer, which added further instability to the sector.

Growth in Europe and Africa

Europe stood out with a 2.1% increase, marking its fifth consecutive year of growth. This progress reflects strategic transitions toward sustainability, technological innovation, and robust market conditions. Increased demand for species such as Atlantic salmon, sea bass, and gilthead sea bream, supported by strong international pricing, played a significant role.

Africa experienced a notable 9.1% increase in aquafeed output, albeit from a modest base. This growth reflects increasing adoption of commercial feeds and rising demand for affordable protein sources. In the Middle East, production dipped slightly by 0.6%, though the regional aquaculture industry remains relatively stable.

Oceania recorded the strongest growth rate in 2024, rising by 9.3%. This growth was driven by the launch of new aquaculture ventures and the diversification of farmed species. Government support and proximity to Asia-Pacific markets also contributed to this expansion.

Spotlight on China and Asia’s key markets

Table 5 shows the top 10 aquafeed-producing countries. They accounted for 41.57 million tonnes, representing 78% of global aquafeed production in 2024. Notably, six of these top 10 countries are in Asia, contributing approximately 83% of the total volume among the leading producers, underscoring the region’s vital role in global aquaculture feed output.

Table 5 shows the top 10 aquafeed-producing countries. They accounted for 41.57 million tonnes, representing 78% of global aquafeed production in 2024. Notably, six of these top 10 countries are in Asia, contributing approximately 83% of the total volume among the leading producers, underscoring the region’s vital role in global aquaculture feed output.

China remains the world’s largest aquafeed producer, accounting for roughly 43% of global output. However, its production volume declined in 2024, indicating a broader industry adjustment. Freshwater fish feed—representing about 60% of China’s aquafeed market—was particularly affected by lower market demand and declining prices.

According to recent figures from a Chinese agricultural publication, 44 domestic aquafeed companies exceeded 100,000 tonnes in annual sales in 2024, contributing 17 to 18 million tonnes, around 89% of national production. These companies are categorised into three tiers:

• Tier 1: Companies with over 1 million tonnes in annual sales (Haid, Tongwei, New Hope), producing 8.8 to 9.1 million tonnes (46% of national total), up 4% year-on-year

• Tier 2: Companies producing 500,000 to 1 million tonnes (Yuehai, Evergreen, Aohua), contributing 2.3 to 2.6 million tonnes (13%).

• Tier 3: 38 companies producing between 100,000 and 500,000 tonnes, totalling 5.9 to 6.3 million tonnes

Increases in the Philippines, Vietnam, and India

Several countries within Asia posted mixed results in 2024. The Philippines recorded the highest increase, adding 352,000 tonnes, likely fuelled by strong domestic seafood demand and government support. Vietnam followed with a 140,000-tonne increase, linked to rising export demand for pangasius. India’s aquafeed production grew by 38,000 tonnes, suggesting a continued transition toward compound feed use in carp farming.

Declines in others

Conversely, Bangladesh saw a decline of 17,000 tonnes, due to flood related disruptions, while Indonesia experienced a significant drop of 140,000 tonnes, attributed to disease and environmental challenges (Table 5).

Outlook: Resilience and innovation amid pressure

While the aquafeed market faced declines in several regions in 2024, particularly in China amid ongoing structural adjustments, the long-term outlook remains optimistic. As aquaculture continues to lead global seafood production for human consumption, the sector’s sustainable growth will rely increasingly on the availability and adoption of high-quality compound feeds.

This is evident in the strategic moves by leading Chinese feed companies, which are expanding beyond domestic markets to capture growth opportunities in emerging regions. Rather than signalling weakness, current challenges are prompting greater resilience across the industry, encouraging innovation, and enhancing the sector’s capacity to adapt and grow within a rapidly evolving global landscape.