At TARS 2025, what is Asia’s position in the global context amid significant crop disruptions, increasing supply from Ecuador, and heightened attention on China?

The opening session, “State of Global Shrimp Supply and Demand,” at TARS 2025 (see pages 4-6), outlined the prevailing circumstances in Asian shrimp aquaculture. The industry faces oversupply, intense competition, and declining prices, all of which challenge supply chain collaboration. While Asia contends with production instability, Ecuador continues to dominate as the primary supplier.

Shrimp and stress: Is the Asian shrimp model broken?

Shrimp has become cheaper year after year, even as consumption is higher than ever. Robins McIntosh, Executive Vice President, CPF, Thailand, responded to the question: is the Asian shrimp culture model broken? His answer—no, but it is misunderstood. He offered a diagnosis of how Asia, aquaculture’s most dynamic region, risks sabotaging itself.

Prices down, production up

Reviewing the situation in the past three decades, Robins showed how inflation-adjusted wholesale prices for shrimp in New York have fallen relentlessly. Yet production has surged past 6 million tonnes annually. Neither low prices nor disease have deterred supply.

The model is not broken; there is just a huge variation.

“World production has gone up and continues to go up at lower prices. This means that producers farming in the right way are making money and others are struggling. Unfortunately, we hear more of the strugglers than successful ones, especially in Asia. What we do hear is the Ecuadorian story, that’s right,”

said Robins.

Both Asia and Latin America have contributed: India and China on one side of the Pacific, Ecuador on the other. Each region has grown at roughly 160,000 tonnes a year since 2018. “The paradox is concerning, depending on who you are. Shrimp is now cheapest when production is at its highest. For now, consumers are happy, but farmers less so.”

Defining the Asian shrimp model

Asia’s system is built on intensity. Two variants dominate. Intensive culture relies on aeration of 10–35HP/ha, balanced feeds, some biosecurity, and domesticated post larvae. Stocking densities run between 25-100 PL/m2 and cost of production (COP) ranges from USD3–3.50/kg. The super-intensive culture models need aerators of >35HP, lined ponds, shrimp toilets, chemicals and probiotics. When stocking is above 150 PL/m2, COP is more than USD4/kg. By 2024, nearly three-quarters of Asia’s shrimp came from these two systems. Intensive alone accounts for close to 60%, meaning it effectively sets the industry’s base price.

Robins observed that super-intensive farms, despite their technological allure, struggle to compete as higher costs erode margins in a sector where prices are falling.

Pushing boundaries

For many farmers, Robins noticed that the temptation is to chase yield by increasing stocking densities ever higher.

“Yet ponds and regions have carrying capacities. It is possible to increase carrying capacity with higher aeration but there is a limit. As feed rates increase, nitrogen and carbon dioxide accumulate, dissolved oxygen falls, and bacterial loads spike. At a certain point, stress tips shrimp into health crises.”

The view is that the cycle often begins in the hatchery. Vibrio bacteria, their plasmids and toxins, and Enterocytozoon hepatopenaei (EHP) infect post-larvae long before they reach ponds. Once inside, the combination of high density and abundant feed allows Vibrio to thrive. Vibrio is rarely lethal on its own, but it opens the door for everything else.

“Technology should be used to reduce costs, not to chase production at any cost,”

– Robins McIntosh

Pathogens in synergy

Shrimp exposed to both Vibrio and nitrite stress fare far worse than with either alone. Add EHP to Vibrio, and mortalities spike. White spot syndrome virus (WSSV) has not mutated dramatically. Robins claims that Vibrio reduces shrimp’s tolerance to it, helping explain the resurgence of WSSV in India in recent years. In short: introduce Vibrio into any equation, and trouble follows.

Geographical factors

Geography makes a difference too. Ecuador is blessed with moderate temperatures, and they have built a model of steady, low-stress aquaculture. India, by contrast, grows shrimp in smaller ponds at similar stocking densities. India has been Asia’s standout success story, demonstrating that careful management can deliver volumes Southeast Asian farmers are less fortunate: high coastal temperatures favour Vibrio. Along the Gulf of Thailand, it is far harder to farm today than it was 20 years ago.

Adding to the strain is seawater quality. Coastal waters across Asia have deteriorated, making ponds ever more vulnerable. The environmental baseline which intensive aquaculture was built upon has shifted.

Growth or resilience?

Genetics pose another challenge. Robins said,

” CPF’s “Turbo” strain can hit 50g in 100 days, compared with just 30g for its slower cousin “Kong”. Yet the speedy Turbo proves fragile: its survival rates fall dramatically when confronted with nitrite stress, white faeces syndrome (WFS) or viral challenges. Kong, on the other hand, is slower but sturdier and holds up better.”

Immune markers confirm the trade-off. He asked if growth must come at the expense of resilience?

Robins also showed that the tolerance for WSSV comes with mid growth levels.

“In the future, with genomics, we can delink growth from disease tolerance at individual levels. So, for now, farmers must balance growth against survival.”

When stress is controlled

The data that Robins presented suggest that restraint works. In 2010, typical Asian farms stocked 75–100 PL/m2, yielding 13 tonnes/ha with survival rates of 85%. By 2022, densities had risen to 300–450 PL/m2. Yields rose to 33 tonnes, but survival collapsed to 65% and failure rates soared above 25%.

In 2023, farms that cut densities back to 100–120 PL/m² found a sweet spot. Yields remained high at 31 tonnes/ha, survival rebounded to 85%, and failure rates dropped below 2%. Feed conversion ratios improved, and average daily growth accelerated. Even EHP-positive shrimp performed well when stress was kept low. Robins’ message was simple: high-stress farming is unsustainable; controlled stress is profitable.

Lessons for Asia

Robins’ conclusions were clear. The Asian shrimp model is not broken; it is mis-applied. Technology should be used to reduce costs, not to chase production at any cost. In practice, this means focusing on balanced feed, adequate aeration, domesticated broodstock, and biosecurity. Hatchery sanitation must be re-emphasised.

Crucially, cost leadership will not come from super-intensive systems. The market’s base price is set by intensive farms, and lower-intensity producers will continue to define competitiveness. Super-intensive ventures, with heavy capitalisation, risk losing flexibility: the pressure to stock at extreme densities to justify investment compromises resilience.

Robins reiterated that Asia remains the volume leader, but it faces a choice. It needs to recalibrate towards lower-stress, more robust production, or risk sacrificing competitiveness. The global shrimp industry will not shrink. The real test is whether Asia can adapt its model to remain on top.

The take-home message was succinct: stress kills. Reduce culture stress, and “no stress, just happiness” follows for farmers, shrimp and consumers.

How the next generation in Krabi transformed their farm. In Thailand’s Krabi province, Yanisa and Khemika Klomsuwan have quietly created a model that other farmers can learn from. The Klomsuwan sisters delivered an insightful presentation at TARS 2025 on how their family owned Kieangseng Kitcharoen Farm, once struggling with disease, high waste output, and low yields, was transformed into a data driven, biosecurity, and globally aligned shrimp operation.

The sisters’ story is not merely about upgrading a farm; it was a critical mindset shift from being reliant on intuition towards

adopting an industrial system of standard operating procedures (SOPs), metrics, and discipline. This shift successfully

increased both output and credibility in global markets.

The old way: Trial and error

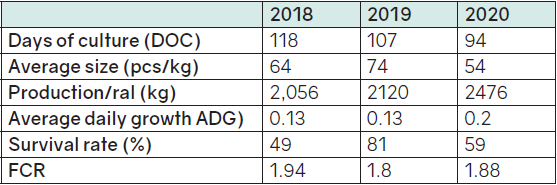

Before the overhaul, the farm’s performance reflected regional norms. Yanisa started with some performance data. “We had a 120 day cycle, which produced only 23 tonnes per rai (1rai = 1,600m²) and an average daily growth (ADG) of just 0.25g. Feed conversion ratio (FCR) was high, and there was limited data on FCR, survival, or pond level variation.”

Diseases particularly EHP and WFS were recurring.

“We could not manage waste well and instead water was exchanged heavily to keep ponds productive, increasing costs and biosecurity risks. Like many Thai farms, there was little awareness of global trends that are beginning to define market access,”

added Khemika.

A strategic pivot

The sisters created a new framework focused on fourgoals: risk reduction, cost saving, shorter days of culture (DOC), and higher efficiency.

“Our targets were ambitious: to reach 5–8 tonnes/rai, reduce cycles to90–110 days, and achieve an 80% success rate per cycle. We also implemented a vision to align with global sustainability standards,”

said Khemika.

Before the cycle: A biosecurity fortress

The foundation of their culture system is built on strict biosecurity, sediment control, water quality management, and ongoing laboratory testing for bacteria and post larvae (PL) health.

“The target set is 80% success rate per cycle,” said Khemika (right). “The transformation has delivered remarkable results; the duration was reduced from 120 days to 90–110 days, and ADG improved from 0.25g to 0.4g,” said Yanisa (left).”

Farm access is closely monitored. Net fences exclude carrier animals, and bird nets block airborne vectors such as white spot syndrome virus (WSSV).

“We only allow the farm manager to lift feeding trays for each pond, each week,”

noted Khemika.

Sediment management remains a priority. Turbidity (NTU) must be below 2.5 before stocking, as it indicates water clarity and sludge levels.

It all begins with good post larvae

PLs undergo forensic examination. Khemika states, “Specifically, we prefer that PL must show no broken rostrums, clean appendages, etc. Hepatopancreas checks confirm lipid integrity and the absence of melanisation (a disease marker). Laboratory plate counts confirm bacterial loads are below thresholds (<1,000CFU/mL for Vibrio strains). The visual PL

inspection also confirms there are no dead, bluecoloured, or milky muscle shrimp.

During the culture: Discipline in motion

Once stocked, the farm shifts focus to measurement and adjustment. Yanisa listed detailed metrics.

“Water parameters in terms of calcium, magnesium, and potassium are related to salinity and are kept within strict ranges. Particularly, alkalinity is kept at 160-200 until size 20g and at 140-160 when shrimp are larger.”

Dissolved oxygen must stay above 5.5mg/L. Transparency is maintained at 40cm throughout the culture period. The goal is to minimise sludge and keep water quality stable.

Bacterial load is constantly monitored in both pond water and shrimp hepatopancreas, with Vibrio counts maintained within strict limits (<100–1,000CFU/mL). Separate “treatment ponds” are tested to ensure that reserve water is free of pathogens.

“With regards to probiotics, we only use certified strains screened for banned substances,”

said Yanisa.

“Growth is tracked weekly starting from DOC 45 when PL is 10.5g. Sampling every Tuesday verifies feeding schedules. The target ADG is 0.45g/day. If PL is less than 10.5g, we investigate.”

Numbers after the shift

Yanisa elaborated,

“The transformation has produced impressive results. Our cycle duration decreased from 120 days to 90–110 days. We tripled the yield, from 2–3 tonnes to 5–8 tonnes per rai, with an average shrimp weight of 30–55g. ADG increased from 0.25g to 0.41g. Recently, to lower costs due to low prices, we used PL12, and our ADG was 0.40g.”

The farm’s data show consistent improvements year-on-year from 2021 to 2025, culminating in Q1 2025 with steady outputs of close to 6-8 tonnes per rai in less than 100 days.

An anatomy of success

The sisters attribute their achievements to five elements:

• Pathogen-free post-larvae from certified hatcheries.

• High-quality feed with balanced nutrition.

• A data-driven approach with continuous data collection and adjustments.

• Maintaining KPI discipline to keep standards high.

• Collaborative teamwork, where staff share responsibility for outcomes.

The key takeaway is that the Klomsuwans’ achievements are not just higher output but also how process-driven aquaculture can be profitable while staying sustainable.

“We set the KPIs and bonus for farm managers, and together, we see that everyone is working toward the same goals and vision,”

concluded Khemika.

How Ecuador became the global shrimp powerhouse

How did Ecuador, better known for oil and bananas and with only 220,000ha of shrimp area become the world’s most efficient farmed shrimp producer? For more than a decade the country has defied forecasts of stagnation and instead has grown shrimp output at an astonishing 16% annually for the last 8 years.

In 2025, production is expected to reach 1.76 million tonnes, up 17% in a single year. For a country of just 18 million people and 260,000km2, this is nothing short of a miracle.

“Every year I think we’ll grow less, but every year the numbers surprise me,”

said Pablo Montalbetti Gómez de la Torre, Corporate Executive Manager for Market Strategy & Market Intelligence at Vitapro-Alicorp S.A.A, as he presented at TARS 2025 on the three forces that contributed to Ecuador’s ascent: natural advantages, industrial organisation, and relentless innovation.

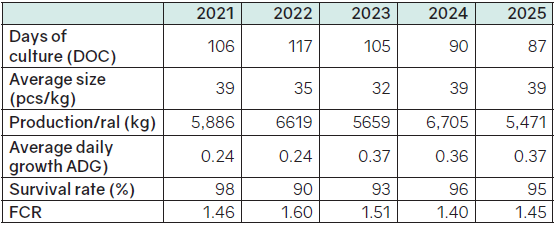

Ecuador’s exports have been transforming its nature its target by increasing value added (processing plant capacity) and by diversifying its (reducing dependency on China). Source: Estadistic & Gluna Shrimp.

“Every year I think we’ll grow less, but every year the numbers surprise me,”

– Pablo Montalbetti Gómez de la Torre

Natural geography and efficiency

The country’s geography is a natural advantage. Around 80% of production comes from Guayas province, a compact coastal region where ponds are a short distance from ports. The proximity translates into faster harvesting, tighter quality control, and lower transport costs. A stable tropical climate allows for year-round production.

Farm efficiency rivals that for the salmon in Chile. Pablo added,

“Feed conversion ratios (FCRs) have improved from 1.6 in 2019 to 1.3 today. For me, matching salmon farms which have a FCR of 1.23, is amazing. “While pond sizes remain unchanged, stocking density is now 16-18 PL/m2 up from 8-9 PL/m2. Weekly growth rates have surged from 1.5g/week in 2019 to 2.75g in 2024 and now to more than 4g in 2025, while pond density has nearly doubled without reducing survival. Some producers now report 7,000 pounds (3.1 tonnes) per harvest cycle. With a 2-phase system, 60 days/cycle and 4-5 cycles/year, we have an extremely efficient production model,”

said Pablo.

More processing and integration

Two transformations are reshaping Ecuador’s shrimp trade. First, exports are moving up the value chain: processed shrimp has jumped from 28% of exports in 2019 to 55% today. Second, the country is reducing its dependence on China, which once absorbed two-thirds of shipments (67%) to 52%. Exports are increasingly diversified towards the EU and US, markets that demand traceability and higher processing standards.

Integration between farms and processing plants is accelerating. Exporters are investing in farms to guarantee at least 50 60% of supply, while farmers are buying into processing plants to avoid price volatility. This blurring of boundaries stabilises margins and supports the shift into higher-value segments.

Pablo said,

“If you ask any shrimp farmer on why they need to integrate, they’ll tell you it is to keep consistent

production, to keep the train going,”

Scale breeds professionalism

Unlike much of Asia’s fragmented industry, Ecuador is dominated by large, professional companies. The top five together contribute more than a third of production. Their scale enables investment in hatcheries, feed mills, auto feeders, electrification and genetics, spreading best practices across the value chain. “Today, almost 20,000ha of farms are electrified, and auto feeders, almost unheard of a decade ago, now cover a quarter of the farmed area.

“The pandemic accelerated efficiency gains. Producers learned to cut costs, digitise operations, and adopt new technologies under pressure. The result is a sector that is leaner, faster, and more resilient than before,”

explained Pablo.

Weaknesses and threats

Ecuador’s political fragility remains its Achilles heel. A dollarised economy, high labour costs, and frequent electricity outages (in 2023 farms endured just eight hours of power per day for months) expose vulnerabilities. Security concerns and trade disputes also loom. Climate shocks, particularly in May and June, can stress animals and disrupt cycles.

Keeping the train going

If current trends hold, Pablo estimates that Ecuador’s growth may moderate to a still impressive 6–8% in 2026, supported by wider electrification, better genetics, and expanded automation. The compound annual growth rate (CAGR) is expected to be at 6% fuelled by technification, electrification and standardisation. The world’s smallest shrimp giant looks set to stay on top.

China’s shrimp market: From white boxes to brands The message on China’s seafood trade by George Ding Changwei, General Manager at Hong Kong Fisheries Holding was simple. “China is now depending less on volume and more on quality, branding, and trust.

“For those seeking to develop in China, the opportunity lies not in chasing higher volumes, but in catering to a shifting consumer base.”

– George Ding Changwei

Over the past three years, China’s shrimp imports have been dominated almost entirely by the vannamei shrimp. Volumes have risen, from some 800,000 tonnes to nearly 900,000 tonnes, but values have fallen. Fierce competition among exporters has depressed prices, leaving many farmers and suppliers squeezed.

More recent figures tell a more nuanced story. In the first half of 2025, China imported 420,000 tonnes of vannamei shrimp, worth about USD2.3-2.4 billion—a sign, Ding notes, of a stabilising market. “For those seeking to develop in China, the opportunity lies not in chasing higher volumes, but in catering to a shifting consumer base.”

Three new types of shrimp consumers

First are the post-1980s and 1990s generation, who have come of age with greater purchasing power and different priorities. Unlike their parents, who cared little beyond having shrimp on the table, younger consumers care about nutrition, food safety and sustainability. They are wary of chemicals, antibiotics and adulteration – issues often exposed on social media platforms such as Douyin (TikTok).

Second is geography. Previously, shrimp consumption was concentrated in wealthy coastal cities like Shanghai or Guangzhou. Today, inland metropolises such as Wuhan, Chongqing and Xi’an are driving growth. A new middle class is developing a taste for shrimp, broadening the consumer market.

Third is the emergence of a new high end consumer tier. Whereas the average consumer once treated shrimp as a homogeneous commodity, now a premium tier has emerged: buyers who will pay for scampi from New Zealand, cold-water prawns from Alaska, or wellbranded vannamei. For them, price is secondary to source and perceived quality.

Ecuador’s lead, India’s push, Thailand’s niche On the supply side, Ecuador remains China’s top shrimp supplier, particularly in head-on, shell-on form. India follows, with Thailand carving out a reputation in small, retail-packaged shrimp sold in high-end supermarkets. Prices reflect these dynamics: Ecuador’s shrimp have fallen fastest in value, while Thailand’s retail-oriented product has been more stable.

China’s domestic shrimp sector, meanwhile, faces headwinds. Labour and feed costs have climbed. Imports exert downward pressure. Seasonality matters: demand peaks before Mid-Autumn Festival and Chinese New Year, but slumps in the hot summer months when seafood spoils easily. Traditional pond-based production lags in quality compared with newer greenhouse systems, which can supply live shrimp more consistently.

From white boxes to trusted brand

The implication for foreign exporters is clear. Competing in China’s shrimp market requires more than shipping containers of “white box” commodity shrimp—the generic, unlabelled product that flooded the country in the past. Consumers, particularly younger ones, want traceability, antibiotic-free guarantees, and a brand they can trust.

Logistics, once a barrier, now make this feasible. Same-day delivery networks in cities such as Shanghai or Beijing allow live and prepared seafood to reach consumers at unprecedented speed. Prepared shrimp dishes, ready-to-cook packs, and branded retail offerings are also booming.

“Today our logistics system is changing very fast, now you can order something in the morning, and have it delivered in the afternoon”

Ding’s advice is to rebuild supply chains, invest in branding, and focus on quality over quantity. With cities like Chongqing (population 31 million) matching entire countries such as Malaysia, the scale is undeniable.

“The market is there,” he says. “But the market you should develop is your brand.”

During the followup panel session, panellists and speakers exchanged views with the audience on the future of shrimp farming, land use, feed trends, tariffs, bacterial management, and the shifting demands of global markets.

Industry player Santhana had this take home message,

“We cannot change our location nor water quality of shared resources, but work at reducing stress to shrimp as much as possible. Improvements in crop cycles will come with a nursery phase and multiphase farming. On marketing, the move from HOSO to peeled shrimp will definitely be of value for Asian producers.”

“On marketing, the move from HOSO to peeled shrimp will definitely be of value for Asian producers”

– S Santhana Krishnan

Feed trends

A decade ago, farmers had little choice beyond generic feed. Today, the feed industry offers stage-specific diets and more tailored formulations. Yanisa reported that crude protein levels in Thai feeds range from 35– 42%. Robins added that Ecuador typically runs closer to 35%, with Thailand averaging 38%. He warned, however, that farmers’ tendency to increase protein can backfire, raising mortality and pond nitrogen levels without improving growth. “Decoupling protein from growth is the real frontier,” Robins argued.

Integration and farm structures

The panel diverged on integration models. Robins observed that in the Americas, large growers have absorbed smaller farms, leading to consolidation, while Asia remains highly fragmented, with farm sizes far smaller by comparison. Santhana added that in India, harvest timing is still determined more by disease outbreaks than market planning, making large-scale integration unlikely.

Market outlook and food safety concerns

Ding acknowledged that Chinese farmers face price pressure from imports but said government protection or intervention is unlikely given the fragmented nature of the industry. Pablo noted Ecuador’s strategy is to diversify away from China by developing differentiatedproducts and export markets. On consumer concerns, ranging from antibiotic resistance to carbon footprints, Santhana argued that adoption of certification standards is growing, though still uneven among smallholders.

Margins and regional variation

Finally, when asked about farmer profitability in Ecuador, Pablo stressed that margins vary widely by season and geography, emphasising the volatility of the sector.