Jogjakarta based JALA Tech has released its SHRIMP OUTLOOK 2025 which gives a comprehensive analysis of the Indonesian shrimp farming industry, focusing on productivity, challenges, and market dynamics.

Jogjakarta based JALA Tech has released its SHRIMP OUTLOOK 2025 which gives a comprehensive analysis of the Indonesian shrimp farming industry, focusing on productivity, challenges, and market dynamics.

Using primary data from the JALA App and secondary data from various sources, the information is used to assist industry players in understanding farming conditions and making strategic decisions. The primary data covers farm performance and secondary covers exports, farmer peceptions and weather conditions.

Indonesian shrimp industry performance

The total estimated production of farmed shrimp 2024 was 287,962 tonnes with 70% (202,464 tonnes) exported. Year 2024 closed with a 9% decline in export volume from 231,413 tonnes in 2022 to 209,066 tonnes in 2023. The domestic market shows potential, with per capita seafood consumption at 41.25 kg/person/year.

During late 2023 to the third quarter of 2024, 73.3% of farmers choose to maintain stocking density of previous cycles. Only 10% of farmers decided to increase their stocking density. On the other hand, a larger portion, around 16.7%, opted to reduce it. Stocking density decision in shrimp farming was directly influenced by farm management practices, from feeding, water fulfilment, partial harvest strategies, to disease risk management.

Since 2023, there has been an increase in the median productivity of shrimp farming, mainly in farms stocking at 80-150PL/m2 (10.35 to 11.55 tonnes/ha) and more than 150 PL/m2 (19.8 to 22.19 tonnes/ha). Region wise, Bali and Nusa Tenggara showed a two-fold increase in productivity, in terms of improved survival rate and average daily growth.

In cost in production, most farmers cited feed as the main component in farming operational costs at 50-70% of total costs, followed by energy (electricity and fuel). According to JALAs survey, farms reduced costs of production by lowering medication, feed, and labour costs.

Based on farmer testimonies, shrimp farming profitability in 2024 was lower because of unstable shrimp prices, while the cost of feed, farm supplies, and other operational

needs continued to rise and squeezed profit margins.

Challenges in shrimp farming

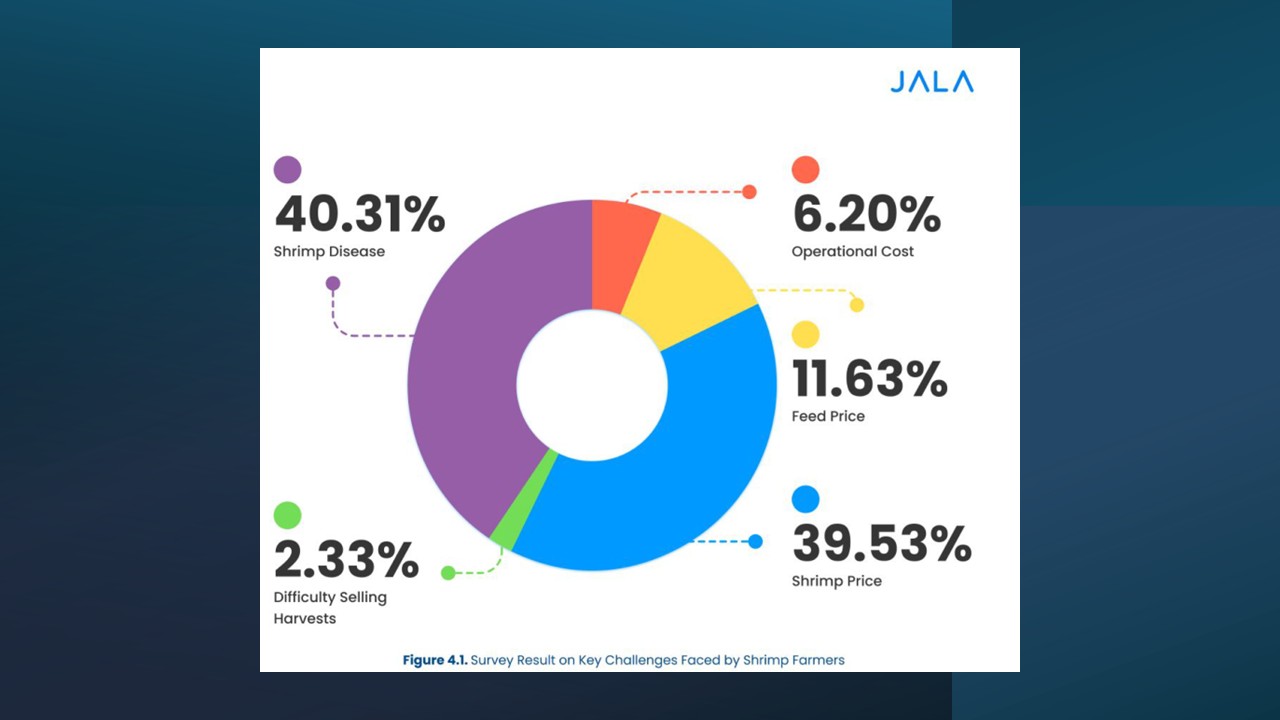

Shrimp diseases, particularly EHP/HPM, are the primary concern for 40.31% of farmers, followed by price fluctuations at 39.53%. Farmers reported that feed prices and operational costs are significant challenges, with 11.63% and 6.20% respectively.

EHP/HPM emerged as the most widespread disease in 2024, affecting growth rates and causing economic damage. Farms in the middle category affected by EHP recorded survival rates of only 62.7%, as compared to the 74.18% recorded by the top 10%.

AHPND was previously a major concern but has seen a decline in prevalence. Effective treatments for EHP/HPM remain limited, complicating disease management. JALA emphasised the need for improved disease management and communication among farmers.

Shrimp price fluctuations

Shrimp prices experienced sharp declines in July and December 2023, with a rebound in May 2024. According to shrimp prices data from 2022 to 2024, shrimp size 100/kg recorded the highest price fluctuation. In contrast, size 70 showed the least fluctuation, indicating better price stability compared to other sizes.

Price trends are influenced by export market conditions, particularly demand from the U.S. and China, including oversupply situations that drive prices down.

Regional performance in shrimp farming

This Shrimp Outlook 2025 report indicated that in Sumatra, productivity declined from 20.55 tonnes/ha in 2023 to 16.72 tonnes/ha in 2024 due to widespread EHP infections. Farming cycles shortened to 97 days, with a median harvest size of 60 shrimp/kg.

In Java, Productivity increased slightly from 10.09 tonnes/ha in 2023 to 10.61 tonnes/ha in 2024, though still below 2022 levels. Survival rate was stable above 75%. Farming duration was the shortest among all regions (79 days), achieving a median harvest size of 62 shrimp/kg.

In Sulawesi, productivity rose from 35.17 tons/ha in 2023 to 36.36 tons/ha in 2024, making it the second-highest region. Sulawesi maintained the longest farming duration (101 days) and achieved the best median harvest size of 55 shrimp/kg.

Bali-Nusa Tenggara showed a productivity which nearly doubled from 25.12 tonnes/ha in 2023 to 43.41 tonnes/ha in 2024, the highest among all regions. Survival rates and ADG (average daily growth) improved, and FCR (feed conversion ratios) became more efficient. Farming duration declined to 82 days, with a median harvest size of 74.5 shrimp/kg, the lowest among regions.

The report summarised that Bali-Nusa Tenggara showed the most significant improvement in productivity and efficiency, while Sulawesi demonstrated consistent performance with the longest farming duration. Java and Sumatra faced challenges, with Sumatra experiencing the most decline due to disease outbreaks.

Sustainability in shrimp farming

There is the importance of sustainable practices to mitigate environmental impacts, such as mangrove deforestation. JALA’s initiatives include integrating technology and restoring mangrove areas to enhance biodiversity. Sustainable farming practices are essential for balancing productivity and environmental preservation.

Future outlook

The report expressed optimism for the Indonesian shrimp industry, highlighting resilience and the potential for growth. It calls for improved communication and collaboration among farmers to address disease challenges. In 2025, the expectations focussed on sustainability and market positioning for Indonesian shrimp.

In 2025, the shrimp industry is expected to focus on the following key areas:

1. Sustainability: Strengthening sustainable farming practices while adhering to environmental and farm regulations.

2. Efficient Programs: Allocating funds to impactful programs to address uncertainties in global market competition and farm gate prices.

3. Certifications: Investing in certifications or collective certifications to enhance the credibility of Indonesian shrimp in global markets.

4. Branding and Promotion: Positioning Indonesian shrimp as a premium product in both domestic and international markets.

JALA Tech’s CEO Liris Maduningtyas highlighted the resilience and perseverance of shrimp farmers, noting an increase in shrimp farm productivity despite challenges such as fluctuating global shrimp prices.

While affirming, JALA’s commitment to supporting farmers through innovation, sustainability, and a reliable supply chain ecosystem, encouraging optimism and collaboration for the future of the shrimp industry in 2025, Liris emphasizes the potential of Indonesia’s domestic market and the importance of sustainability in shrimp farming.

JALA Tech is a standout aquaculture technology company based in Yogyakarta, Indonesia, making waves in the shrimp farming industry with its data-driven, end-to-end solutions. JALA offers a full ecosystem for shrimp farmers, combining hardware, software, and operational support: An App for real-time monitoring of water quality, shrimp growth, and farm productivity; a rugged, precision tool for water quality measurement; Joint farm operations with technical and business support and direct market access for farmers, ensuring fair prices and fast transactions. JALA has:

• Digitized over 11,000 shrimp farms across Indonesia.

• Raised over USD20 million in funding, including a USD16M Series A round backed by Intudo Ventures, SMDV, Mirova’s Sustainable Ocean Fund, and The Meloy Fund.

• Launched the Climate-Smart Shrimp Farming (CSSF) initiative, blending tech, mangrove restoration, and regenerative aquaculture. A pilot in Central Sulawesi showed a 10x productivity increase.